Newsindhs.com l Independent News Desert Hot Springs

July 21, 2019

In this video I tested 5 different companies worth almost 100 billion in value to see if the cashiers and managers would allow me to use a debit card that did not belong to me.

I went into Del Taco, McDonalds, Subway, Vons and Home Depot collectively valued at almost a hundred billion dollars to ask them if it was alright if I used a Debit Card that belonged to someone else and all 5 agreed that I could get away with it.

Granted I could have gotten away with it for various reasons depending upon the different locations.

This is a very important point right here! I am not here to say that I think any of the cashiers or employees did anything wrong. In fact I think they all did nothing wrong when handling my questions.

I was simply trying to get the point of sale’s perspective on the issue. Besides, the point of sale employees confirmed what we already knew. What we knew was that no one checks identification when we insert our chip card into the slot and type in our pin numbers already. We knew this was going on but after hearing employees confirm it sheds a brighter light on the transactions.

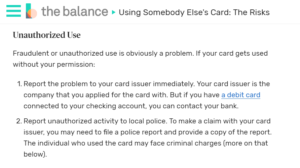

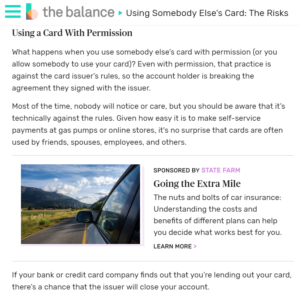

Here are some excerpts from an article from the website thebalance.com

“What happens when you use somebody else’s card with permission (or you allow somebody to use your card)?” “Most of the time, nobody will notice or care, but you should be aware that it’s technically against the rules. Given how easy it is to make self-service payments at gas pumps or online stores, it’s no surprise that cards are often used by friends, spouses, employees, and others.”

“Get Permission in Writing TIP: If you must use somebody else’s card (which you really shouldn’t do) get a signed note from the cardholder saying you have permission to do so.

Keep the note tucked away unless you really need it. If you use the card at a store, the merchant does not want to know that you have somebody else’s card—they’re risking a chargeback, and stores stand to lose money unless the authorized cardholder made the purchase.”

I do think that the burden lies on the cardholder to make sure people who are not authorized to use his/her card don’t. Obviously for years now we’ve not been asked for our i.d. to purchase things sometimes valued at thousands of dollars with a Debit Card.

We see it all the time that identification is almost never asked for in ordinary purchases by Debit on a daily basis.

What this test does show is that the financial system is wide open for fraud to take place on the lower level.

Mostly what can happen is a type of ‘loaned out’ fraud. It’s still not permitted to loan a debit card out to anyone but I’m sure we would agree it’s done all the time.

Just think of the billions and billions of dollars in money spent that occur each year by people whose names do not appear on the debit card they are using.

Retailers aren’t going to ask for identification if they don’t have to because that might jeopardize the sale. They only stand to lose money on the deal if they speak up.

They have a financial interest in leaving the door wide open for consumer fraud on the daily level knowing that most purchases end up without resulting in a chargeback.

And the consumer, well we know the consumer who is using the card fraudulently, you and I know that they want the deal to go through. That’s why they are standing at the register with goods in their hands.

So why does our bank card industry allow so much opportunity for misuse of debit cards?

What do you think? Leave a comment below.